Answer:

$19.0148

Step-by-step explanation:

Using the dividend growth model, we know

Where P0 represents the current price of the share.

D1 represents dividend to be paid at year end.

Ke represents the required rate of return

g represents the expected permanent growth rate.

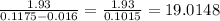

As provided putting all the values in the equation we have:

P0 =

Therefore, the price to be paid today for this share = $19.0148.