Answer:

D. For a higher interest rate, an annuity has a smaller future value

Step-by-step explanation:

If the interest rate increases, then the capitalization factor on the annuity increases making the annuity future valeu increase:

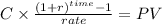

on the capitalziation factor we got rate in both part of the division:

on the top part is being added a unit and power to t

while in the other it doesn't change.

While it is true that a higher dividend makes the quotient decrease, the increases in the top part exceeds by far the increase in the bottom part, making increase the quotient.