Answer:

Equivalent Annual Cost -$ 4,833.000

Step-by-step explanation:

The equivalent annual cost is the equivalent cost per year to all the cost associate with the project. In this case, the manufacturing cell's overhaul

F0 250,000

cash flow per year:

36,000 revenue + 12,000 per year

cost outflow per year:

15,000 expenses + 7,500 per year

net:

21,000 inflow per year + 4,500 inflow per year

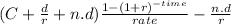

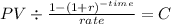

present value of an arithmetics annuity:

C: 21,000

d: 4,500

r = Minimun accepter rate of return: 15%

time 9 years:

$166,599.93

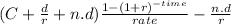

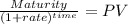

present value of the salvage value:

Maturity 8,000.00

time 9.00

rate 0.15000

PV 2,274.10

present worth:

166,599.93 + 2,274.10 - 250,000 = -81,126

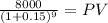

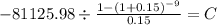

Now, to know the equivalent annual cost we calcualte the PMT of the present worth:

PV -81,126

time 9

rate 0.15

C -$ 4,833.000