Answer:

a) $59.244 million

b) $20.291 million

c) Weight of equity = 0.7448 and Weight of debt = 0.2552

Step-by-step explanation:

Data provided:

Number of shares of common equity = 1.2 million

Book value per share = $1.40

Market value = $49.37 per share

debt with a par value = $ 19.7 million

Now,

a. market value of its equity = Market value per share × Number of share

= $49.37 × 1.2

= $59.244 million

b) Market value of its debt = 103% × Value of debt

= 1.03 × 19.7 million

= $20.291 million

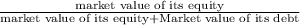

c) weights to be used in computing its WACC

Market Values are used in calculating WACC

Weight of equity =

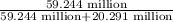

=

= 0.7448

and,

Weight of debt = 1 - Weight of equity

= 1 - 0.7448

= 0.2552