Answer:

rate of return is 8%

Step-by-step explanation:

given data

cash = $100,000

receives interest = $6,000

sells the bonds = $102,000

to find out

rate of return

solution

we will apply here Rate of return formula that is

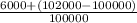

rate of return =

.....................1

.....................1

here I is interest receive and A1 is sells the bonds

and Ao is cash

put her all value in equation 1 we get

rate of return =

rate of return = 0.08

rate of return is 8%