Answer:

r4 = 3.66 %

r5 = 4.51 %

r6 = 4.61 %

Step-by-step explanation:

given data

interest rates = 2.25 %

interest rates = 2.60 %

interest rates = 2.98 %

interest rates = 3.25 %

time = 3 year

time = 4 year

time = 5 year

time = 6 year

to find out

expected one-year rates during years 4, 5, and 6

solution

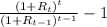

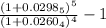

we will apply here formula of unbiased expectations theory for expected interest rate that is

r =

..................................1

..................................1

here r is expected one yea rate of interest

t is denoted year

and R is reported rate of interest

so put here value for 4 year

r4 =

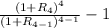

r4 =

r4 = 0.0366

r4 = 3.66 %

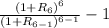

and now put value for year 5 in equation 1

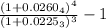

r5 =

r5 =

r5 = 0.0451

r5 = 4.51 %

and

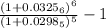

now put value for year 6 in equation 1

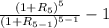

r6=

r6 =

r6 = 0.0461

r6 = 4.61 %