Answer:

Miller Bond:

Today: 1,166.63

1-year 1,159.83

4-years 1,135.90

9-years 1,081.11

13-years 1,018.86

14-years 1,000 (maturity)

Modigliani Bond

Today: 851.01

1-year 856.25

4-years 875.38

9-years 922.78

13-years 981.41

14-years 1,000 (maturity)

Step-by-step explanation:

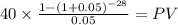

The present value will be the discount coupon payment and maturirty at the YTM rate:

Miller Bond:

The coupon payment are calcualte as ordinary annuity

C 50.00 (1,000 x 10% / 2)

time 28 (14 years x 2 payment per year)

rate 0.04 (8% YTM / 2 payment per year)

PV $833.1532

While Maturity, using the lump sum formula

Maturity $1,000.00

time 28 semesters

rate 0.04

PV 333.48

PV coupon $833.1532 +PV maturity $333.4775 = Total $1,166.6306

For the subsequent time we must adjust t

in one year, there will be 26 payment until maturity

PVcoupon $799.1385

PVmaturity 360.69

Total $1,159.8277

As the bond get closer to maturity it will get closer to face value until maturity when it will equalize it.

We recalculate the same formula with values of:

in 4-year : then 10 years to maturity t = 20

in 9-years: then 5 years to maturity t= 10

in 13-years: 1 year to maturity t = 2

at 14 years: is maturity date so equals the face value of 1,000

Remember: there are two payment per year.

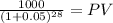

Same process will be done with Modigliani bond:

C 1,000 x 8% / 2 payment per year : 40.00

time: 14 years x 2 payment per year = 28 payment

rate 10% annual rate /2 = 0.05

PV coupon $595.9251

Maturity $ 1,000.00

time 28 semester

rate 0.05

PV maturity 255.09

PV coupon $595.9251 + PV maturity $255.0936 = Total $851.0187

and then we calcualte for the same values of t we are asked for the Miller bond.