Answer:

The cost of new stock exceed the cost of common from reinvested earnings by 0.38%

Step-by-step explanation:

Hi, first we need to find the cost of the current stock, for that, we need to take into account that the dividend of this stock is EPS*(Payout Ratio), that is $2.75*0.7=$1.925. With that in mind, let´s find out what the cost of the current stock is.

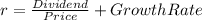

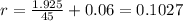

So, the cost of the current stock is:

That is, 10.27%

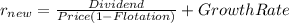

Now, in order to find the cost of the new stock, we have to use the following formula.

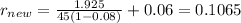

So, everything should look like this.

So, the cost of the new stock is 10.65%

Since the cost of the current stock is 10.27% and the new one is 10.65%, new stock exceed the cost of the current stock by 0.38%

Best of luck.