Answer:

10.51%

Explanation:

Data provided in the question:

Period Initial value = $33.48

Period end value = $35.20

Annual dividend paid = $0.60

Total time = 3 years

Therefore,

the total dividend paid i.e the income = 3 × $0.60 = $1.80

Now,

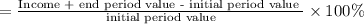

The holding period is given as:

=

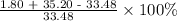

=

= 10.51%