Answer:

Explanation:

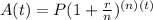

Use the formula

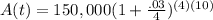

where A(t) is the amount of money in the account after a certain number of years, P is the amount invested initially, r is the interest rate in decimal form, n is the number of times the interest compounds per year, and t is the time in years. Filling in:

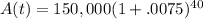

Simplifying a bit:

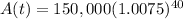

and a bit more:

and a bit more:

and a bit more still:

and a bit more still:

A(t) = 150,000(1.348348612) so

A(t) = 202,252.29