Answer:

Desing A: 23,024,370

Desing B: 22,520,274.6

It should purchase desing B as the capitalized cost is lower.

Step-by-step explanation:

We consider annuity for the overhauls and then, perpetuity to consider this incinerators will last indefinitely.

maintenance cost: 800,000 / 0.05 = 16,000,000

Overhaul:

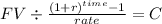

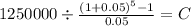

The company will need to fund 1,250,000 every 5 years. We need to determinate the annuity to obtain this future value:

PV 1,250,000

time 5

rate 0.05

C $ $ 226,218.498

Then at perpetuity:

$ 226,218.498 / 0.05 = 4,524,370

Desing A capitalized cost:

2,500,000 + 16,000,000 + 4,524,370 = 23,024,370

We do the same for Desing B:

investment: 5,750,000

maintenance: 600,000 / 0.05 = 12,000,000

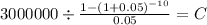

overhaul:

C $ 238,513.725

238,513.73/0.05 = 4,770,274.6

Capitalized cost: 5,750,000 + 12,000,000 + 4,770,274.6 = 22,520,274.6