Answer:

US dollar is worth more

The beer will cost 3.09 US dollars

the dollar will appreciate

Canada is paying higher interest rate

The dollar is selling at premium as the foward rate is higher than spot.

Step-by-step explanation:

As a dollar is worth 1.02 canadian dollar the dollar is worth more

We divide the canadian cost over the spot exchange rate:

3.15 canadian dollar / 1.02 = 3,088 = 3.09

As the foward rate is 1.04 the dollar will appreciate.

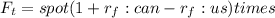

As the foward rate is calculate as follow:

the difference between rates must be positive in order to increase from 1.02 to 1.04 therefore, the canadian dollar has a higher interest rate.

last, the premium on a foward contract is when the exchange rate is higher than the spot rate.

Opposite, a dicount will be lower than spot rate.