Answer:

a) The weight of Security 1 is 23.81%

b) The weight of Security 2 is 33.33%

c) The weight of Security 3 is 42.86%

d) The expected return on the portfolio is 9.81%

Step-by-step explanation:

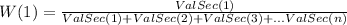

Hi, in order to find the weight of each security, we need to use the following formula.

Where:

W(1)= the weight of security 1

ValSec(1,2,3...n)= amount invested in security 1, 2, 3 to n

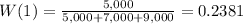

In other words, the weight of a security in this portfolio is equals to the value invested in this security divided by the sum of all the securities in the portfolio. So, for the weight of the first one, we have to do this:

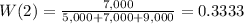

The second:

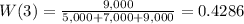

The third:

Therefore, the weight of W(1)=23.81%, W(2)=33.33% and W(3)=42.86%

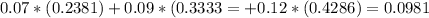

For the expected return on the portfolio, we need to multiply the weight of each security by its return, that is:

So, the expected return on the portfolio is 9.81%

Best of luck.