Answer:

E) $1.47

Step-by-step explanation:

Hi, first we need to estimate the value of all future dividends, since last dividend was $2 and it´s going to grow at -50% every year, for 3 years and then stop paying dividends, the cash flows that we need to bring to present value are.

D(1)= $2*(1-0.5)=$1

D(2)=$1*(1-0.5)=$0.50

D(3)=$0.50*(1-0.5)=$0.25

And no dividends from then on.

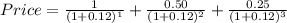

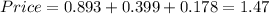

Now, we need to bring them to present value in order to find the pair market price of this share, that is:

So, the price of this share is $1.47, that is E)

Best of luck