Answer:

The effective interest rate, rounded to the nearest tenth, is 0.1%.

Step-by-step explanation:

The banker's rule is the simple interest formula.

The simple interest formula is given by:

In which E are the earnings, P is the principal(the initial amount of money), I is the interest rate(yearly) and t is the time, in years.

The effective interest rate is given by the following formula:

.

.

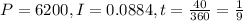

In this problem, we have that:

A man makes a simple discount note for $6,200, at an ordinary bank discount rate of 8.84%, for 40 days. We consider that the year has 360 days. This means that

.

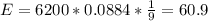

.

So

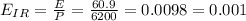

The effective interest rate is

The effective interest rate, rounded to the nearest tenth, is 0.1%.