Answer:

a.- r= 6% Value: 23.40

b.- r = 8% Value: 11.70

c.- r = 11% Value: 6.69

d.- r = 12% Value: 5.85

e.- r= 19% Value: 3.12

Step-by-step explanation:

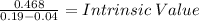

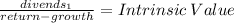

We will calcualte the gordon model for the different rates of return:

Dividend_1 is next year dividends.

If dividends raise by 4% then:

0.45 x 1.04% = 0.468

now we calculate for the different returns: