Answer:

ballon payment: $ 435,151.67

Step-by-step explanation:

We need to solve for the PMT fo the mortgage

Then, the amount amortized for the mortage over an 8 years period

Last, we subtract the amortized amount on the principal to knwo the balloon payment.

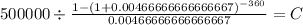

PV 500,000

time 360 (30 years x 12 months)

rate 0.004666667 (5.6% annual rate divide into 12 months)

C $ 2,870.395

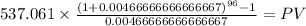

Next, we calculate the amortization on the first period:

payment less interest = amortization

$2,870.395 - $500,000 x 0.004666667 = $ 537.06

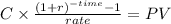

Now the value of this amortization over an 8 years period annuity:

C $ 537.06

time 96 (8 years x 12 months)

rate 0.004666667

PV $64,848.3291

Last, the ballon payment: 500,000 - 64,848.33 = 435,151.67