Answer:

PV = 140,465.70$

Explanation:

Since the values will be paid in the future then we need to find the Present Value of each of the amounts factoring in a interest rate of 4.3%

Given

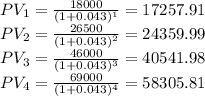

1) Amount = 18,000$ : Period(t) = 1 year

2) Amount = 26,500$ : Period(t) = 2 years

3) Amount = 46,000$ : Period(t) = 3 years

2) Amount = 69,000$ : Period(t) = 4 years

The Present Value formula is as follow

Solving for each of the payments.

Now the total Present Value is calculated by adding all the above answers