Answer:

The journal entries are as follows:

(a) Oil and gas properties A/c Dr. $6,600,000

To cash $6,600,000

(To record purchase)

(b)

Oil and gas properties A/c($570,000 + $450,000) Dr. $1,020,000

To cash $1,020,000

(To record additional testing and preparations)

(c) Depletion expense A/c Dr. $548,640

To accumulated depletion $548,640

(To record Depletion)

Workings:

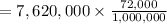

Depletion expense:

= $548,640