Answer:

depreciation per year: 225

Step-by-step explanation:

straight-line depreciation: the depreciation expense will be equally distributed over the assets life.

Also, we must remember that we can only depreciate for the difference between the csot adn the salvage value.

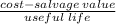

The formula for annual depreciation expense is:

2,400 - 600 = 1,800 amount subject to depreciaiton

1,800 / 8 = 225