Answer:

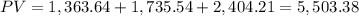

The most he would be willing to pay for the new diagnostic computer system would be $5,503.38

Step-by-step explanation:

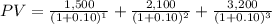

Hi, we need to solve this bringing to present value all the future cash flows, discounted at 10%. This is because we need to find the cost that will equal the present value of all the future and positive cash flows, therefore Anthony will obtain a NPV = 0 (net present value, that is NPV), this is as follows.

Everything should look like this

So, the most that Anthony should be willing to pay for this diagnostic computer system is $5,503 (rounded to the nearest dollar)

Best of luck.