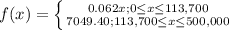

Answer:

where f(x) is the the social security taxes in dollars and x is the amount earned in 2013

where f(x) is the the social security taxes in dollars and x is the amount earned in 2013

Explanation:

The problem states that for the first $113,700 you will pay a tax rate of 6.2% for your income. When taking 6.2% of an amount you can turn the percentage into a decimal number and multiply it by the total income which will be represented by the letter x:

0.062x

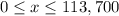

for an interval of

this is the first part of the piecewise defined function. For the next part, the problem states tht the social security tax will be a fixed amoun of $7,049.40, so the second part of the piecewise defined function would be just:

7,049.40

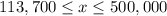

for an interval of

according to the specifications of the problem.

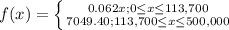

So the whole piecewise defined function will be

where f(x) is the the social security taxes in dollars and x is the amount earned in 2013

where f(x) is the the social security taxes in dollars and x is the amount earned in 2013