Answer:

$3100

Explanation:

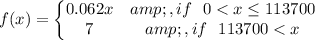

We are given that

If you earned upto $113,700 in 2013 from an employer then your security tax=6.2% of income

If you earned over $113,700 then, you paid amount of tax=$7049.40

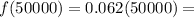

We have to find the social security tax when you would made $50000.

Let x be the income and f(x) be the amount of tax.

Substitute the values then we get

$3100

$3100

When the income of someone is $50000 then you paid the security tax $3100.