Answer:

52.85 / 50.14 / yes

Step-by-step explanation:

the key to answer this question is to understand the logic of present values / future values:

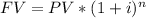

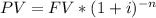

where FV is future value, PV is the present value, i is the periodic interest rate and n is the number of periods. So applying to this particular problem we have:

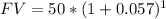

a. if we deposit today 50, we are been asked to calculate the future value, so:

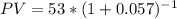

b.if we want to have 53 in one year, we are been asked to calculate a present value:

c. is clear that is better to borrow to the friend because in one year he will pay more than bank