Answer:

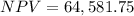

The NPV of this investment is $64,581.75

Step-by-step explanation:

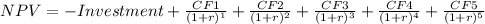

Hi, we need to discount to present value all the future cash flows, the formula to use is as follows:

Where

NPV = Net Present Value

CF = The cash flow stated in the problem by year

r= discount rate (in our case, 0.08 or 8%)

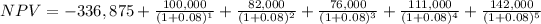

Now, let´s solve this.

So, the net present value of this project is $64,581.75

Best of luck.