Answer:

The required rate of return for the company is 13.8%

Step-by-step explanation:

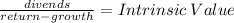

Dividend yield: return of the stock considering his market value:

dividend / Price = dividends yield = 7.7% = 0.078

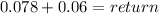

grow = 6% = 0.06

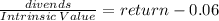

We use the gordon model to solve for required return:

return = 0.138 = 13.8%