Answer:

a) Fund pre-tax Amount $ 179,084.77

b) Funds after-tax $ 163,267.82

c) Dividends after-tax amount : $ 159,813.27

Step-by-step explanation:

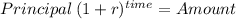

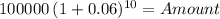

We calcuale the future value of the fund at 6% annual rate over a 10-years period:

Principal 100,000.00

time 10.00

rate 0.06000

Amount 179,084.77

after taxes, as this were held for a longer period will be considered long term gain and taxes at 20%:

179,084.77 - 100,000 = 79,084.77 capital long-term gain subject to taxation

79,084.77 * (1-0.20) = 63,267.82

Now we add the 100,000: 163,267.82

Alternative scenario:

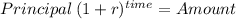

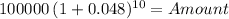

6% less 20% dividends tax after-tax return on dividends:

0.06 x (1 - 0.2) = 0.048

We calcualte the future value using this rate:

Principal 100,000.00

time 10.00

rate 0.04800

Amount 159,813.27