Answer:

overhead rate: $3 per labor hours

Appled overhead for January 25,050 dollars

Applied overhead: 268,800 dollar underapplied by 7,200 dollars

Step-by-step explanation:

expected overhead: 270,000

cost driver: labor hours.

expected labor hours: 90,000

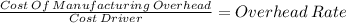

overhead rate: 270,000 / 90,000 = 3

Applied overhead for January

8,350 labor hours x $3 overhead rate = 25,050

for the year:

89,600 x $ 3 = 268,800

actual overhead 276,000

Difference: 7,200

As the actual cost were higher; the overhead was underapplicated.

we need to capitalize more cost.