Answer:

You need to deposit every month $1,692.10 every month, for 480 months, at a rate of 4% compounded monthly to obtain $2,000,000 in 40 years.

Explanation:

Hi, first, we need to convert that 4% compounded monthly rate into an effective monthly rate, that is by dividing by 12, which is 0.04/12=0.00333 or 0.333% effective monthly. Since the time periods are in years, they also need to be converted in months, this time we have to multiply 40 years by 12 and we get 480.

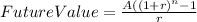

Finally ,we need to solve for "A" the following equation.

Where:

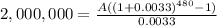

Future Value= 2,000,000

r = our effective monthly rate (0.00333)

n = periods to save (480 months)

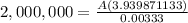

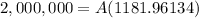

So, it should look like this.

You will need to deposit $1,692.10 every month, for 480 months at a rate of 4% compounded monthly (0.333% effective monthly) in order to obtain $2,000,000 in 40 years.

Best of luck.