Answer:

It will take 71,35 months, wich can be rounded to 72, or 6 years

Explanation:

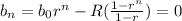

The debt will be paid when

, the formula can be written as:

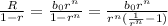

, the formula can be written as:

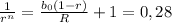

Solving for n:

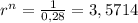

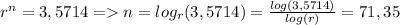

Solving the exponential equation:

It will take 71,35 months, wich can be rounded to 72, or 6 years