Answer:

a. $ 4,276.86

b. $ 680.19

c. $ 6,000

d. $ 4,704.55

e. $ 714.20

f. $ 6,000

Explanation:

The following formula applies to the first two items:

![FV=P[((1+r)^(n)-1 )/(r) ]](https://img.qammunity.org/2020/formulas/mathematics/college/w42d2zdpdt0uildlki1c06yucywj6cic6r.png)

Where:

P = Periodic payment.

r = rate per period.

n = number of periods.

a. $ 200 per year for 12 years at 10%.

In this case: P = $200, r = 10% or 0.1, and n = 12

We replace in the FV formula:

![FV = 200[((1+0.1)^(12)-1 )/(0.1) ]](https://img.qammunity.org/2020/formulas/mathematics/college/xxqnlmzu9tpvv82bwgxaf4kkxk3povpo7a.png)

![FV=200[ (1.1^(12) -1)/(0.1) ]](https://img.qammunity.org/2020/formulas/mathematics/college/qcxvjbd6bgfnzk8n3svz2mjz7yuxo5j75e.png)

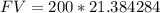

![FV=200[(2.138428)/(0.1) ]](https://img.qammunity.org/2020/formulas/mathematics/college/8fbk1djguzu6ppyy2w5vt5qufna5axuijk.png)

b. $100 per year for 6 years at 5%.

In this case: P = $100, r = 5% or 0.05, and n = 6.

We replace in the FV formula:

![FV = 100[((1+0.05)^(6)-1 )/(0.05) ]](https://img.qammunity.org/2020/formulas/mathematics/college/ey2lr7zm9qvufcysj2yy0no67gmr5kxsgg.png)

![FV=100[ (1.05^(6) -1)/(0.05) ]](https://img.qammunity.org/2020/formulas/mathematics/college/hzyxfkq79hiw04fu9mgna3uca2zupz95fn.png)

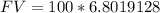

![FV=100[(0.3400956406)/(0.05) ]](https://img.qammunity.org/2020/formulas/mathematics/college/5ypxpdu3pgy4ipq9hnh53sfgbjd7aq0mkd.png)

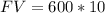

c. $600 per year for 10 years at 0%.

If the interest rate is 0%, simply multiply the amount of money by the number of years during which it will be received.

In this case: P = $600, and n = 10

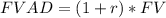

For the items d. and e., the Future Value of Annuity Due must be applied.

![FVAD=(1+r)*P[((1+r)^(n)-1 )/(r) ]](https://img.qammunity.org/2020/formulas/mathematics/college/mtfx88o5o54s5bj51543crss338pcds0ac.png)

It is the same as saying:

d. $200 per year for 12 years at 10%.

In this case: P = $200, r = 10% or 0.1, n = 12, and FV = 4,276.86 (We obtained this in a. ).

We replace in the FVAD formula:

FVAD = 4,704.546 or (rounded) 4,704.55

e. $100 per year for 6 years at 5%.

In this case: P = $100, r = 5% or 0.05, n = 6, and FV = 680.2 (We obtained this in b. ).

We replace in the FVAD formula:

FVAD = 714.1995 or (rounded) 714.20.

f. $600 per year for 10 years at 0%

Because the interest rate is 0, the ordinary annuity is exactly the same as the due one, that is, $ 6,000.