Answer:

Purchases = Number of units × Price per unit

= 1,100 × $50

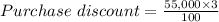

= $55,000

= $1,650

The journal entries are as follows:

(1) On July 15,

Purchases A/c ($55,000 - $1,650) Dr. $53,350

To Accounts payable $53,350

(To record purchase of inventory on account)

On July 23,

Accounts payable A/c Dr. $53,350

To cash $53,350

(To record the payment of cash against accounts receivable)

(2) On August 15, 2018

Accounts payable A/c Dr. $53,350

Interest expenses A/c Dr. $1,650

To cash $55,000

(To record the payment on accounts payable)

(3) Perpetual inventory system:

(i) On July 15,

Merchandise Inventory A/c Dr. $53,350

To Accounts payable $53,350

(To record purchase of inventory on account)

(ii) On July 23,

Accounts payable A/c Dr. $53,350

To cash $53,350

(To record the payment of cash against accounts receivable)

(iii) On August 15, 2018

Accounts payable A/c Dr. $53,350

Interest expenses A/c Dr. $1,650

To cash $55,000

(To record the payment of cash against accounts payable and to recognize interest expense due lost discount)