Answer:

1. NPV if it conducts customer segment research

NPV = $ 11.314782

2. NPV if it goes to market inmediately.

NPV = $ 10.739.130

Step-by-step explanation:

1. NPV if it conducts customer segment research.

In this case you need to use this information:

Initial investmet = $1.120.000 (research cost)

p = 70% (Probability of success)

p = 30 % (Probability of unsuccess)

(you can obtain this probability , using the probability of success and subtracting 70% from 100% )

NPV if successful = $18.200.000

NPV if unsuccessful = $5.200.000

r = 15% (Discount rate)

then

You need to use this formula

NPV = ∑

-initial investment

-initial investment

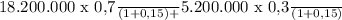

NPV =

- $1.120.000

- $1.120.000

NPV = $ 11.314782

2. NPV if it goes to market inmediately.

In this case you need to use this information:

p = 55% (Probability of success)

p = 45 % (Probability of unsuccess)

(you can obtain this probability , using the probability of success and subtracting 55% from 100% )

NPV if successful = $18.200.000

NPV if unsuccessful = $5.200.000

r = 15% (Discount rate)

then

You need to use this formula

NPV = ∑

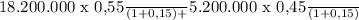

NPV =

NPV = $ 10.739.130