Answer:

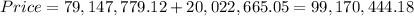

Ans. The price of the bonds on December 31, 2021 discounted at 6% is $99,170,444

Explanation:

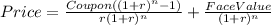

Hi, we need to use the following formula to find the present value of the bond, which is the same as saying, discount all future cash flows to present value.

Where:

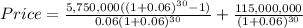

r= discount rate (in our case 6% or 0.06)

Coupon =$115,000,000*0.05=$5,750,000

n= periods of payment (in our case, 30 years or just 30)

Everything should look like:

The price of the bond to the nearest whole dollar is $99,170,444

Best of luck.