Answer:

Ans. The current price of the stock is $56.82

Step-by-step explanation:

Hi, well, the problem here is that we have different discount rates, in other words the required rate of return for the stock changes several times, therefore we are going to break this problem in 3 parts, or bring to present value all the cash flows in 3 steps. Let´s start with the value of the dividends.

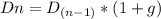

We have to use the following formula.

Where, D(n-1) is last dividend and Dn is the dividend that we are looking for, for example, D1 = 3.10*(1+0.06)=3.29, D2=3.29*(1+0.06)=3.48, and so forth. The amount to pay on dividends per share is,

D1=3.29; D2=3.48; D3=3.69; D4=3.91; D5=4.15; D6=4.40; D(7)=4.66

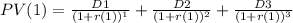

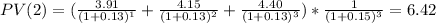

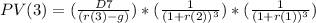

Since the first 3 years are to be discounted at a 15%, this is how the formula should look like.

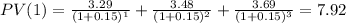

Now, for the second part, we have to bring all cash flows to year 3 at r(2)=13% and then bring it to present value at r(1)=15%. This is because we have 2 different discount rates, this is as follows.

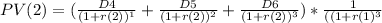

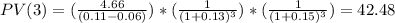

Finally, we need to bring all the future cash flows from year 7 and beyond, notice that we need to use the return rate r(3) to bring everything to year 6, then we have to bring it to year 3 and then to present value, everything as follows.

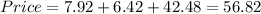

So, the price of the stock is PV(1) + PV(2) + PV(3), or:

Price= $56.82/share

Best of luck.