Answer:

YTM = 4.40%

Step-by-step explanation:

From current yield we solve for price:

current yield: annual payment/ price

0.07 = 1,000 x 8.5% / price

85 / 0.07 = price = 1214,285714285714 = 1214.29

Now we solve for yield to maturity. This is the rate at which the present value value of the maturity and coupon payment are equal to his current price:

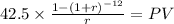

C 42.50

time 12 (6 years x 2 payment per year)

rate (semiannual as the payment are twice per year)

PV coupon

Maturity 1,000.00

time 12.00

rate

PVmaturity

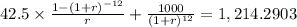

PV c + PV m = $1,214.2903

So we got:

From here we solve using excel or financial calculator as you suggest.

notice this will give you the semiannual rate: 0.021988524 = 2.20%

You will have to multiply the answer by 2 giving you the 4.40% as you were told.