Answer:

Given that,

Expected return on Z and Y,

Rz = 0.15 and Ry =0.35

Standard deviations:

Sz = 0.2, Sy = 0.4

correlation coefficient: rxy = 0.25

Expected return on portfolio = Rz × wz + Ry × wy

where, wz and wy are weights of Z and Y respectively in portfolio.

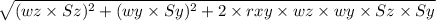

Standard deviation of portfolio:

Table attached with this answer shows mean return and standard deviation at different combinations of weights: