Answer:

Builtrite D should purchase the machine

Explanation:

Cash outflow in year zero = $ 500,000 + $ 25,000 ( training cost ) + $ 30,000 ( Net working capital)

Cash outflow in year zero = $ 555,000

Terminal cash flow in year 10 = $ 150,000 + $ 30,000 ( NWC)

Terminal cash flow in year 10 = $ 180,000

Operating cash flow per year = [ Savings - expenses - depreciation ] X ( 1 - tax rate) + depreciation

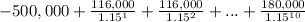

Net present value =

The Net present value of purchasing the machine = $32,071.42

Builtrite D should purchase the machine