Answer:

$50

Step-by-step explanation:

Given,

Current Net income = $2,000,000

No. of common shares today = 500,000

Current market price per share = $40

Anticipated Net income in 1 year = $ 3,250,000

Anticipated No. of common shares in 1 year = 500,000 +150000 =650,000

From this data, then

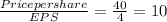

The current Earnings Per Share(EPS) =

Current Price/Earning ratio =

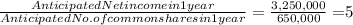

Anticipated EPS in 1 year=

If the company's P/E ratio remain as that of the current at 10, then

The anticipated price of stock in 1 year = Anticipated EPS * P/E ratio in 1 year

= $5 *10 = $50