Answer:

Ans.

a) Assuming that the last dividend was $2.20, this stock is a good buy because to the investors profile, given his/her required rate of return (15%), the maximum price to pay, in order to make earnings equivalent to 15%, is $33.94.

b) The implied rate of return of Large Oil´s stock is 16.46%, assuming that the dividend on the question is the last dividend.

Step-by-step explanation:

Hi, I think the first question that comes up from this answer is. Why do I insist so much on that last dividend deal?. Well, the answer is simple, the equations are not the same.

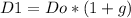

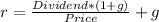

Let Do be last dividend and D1 is next dividen, g is the growth rate. The way they connect to each other is as follows:

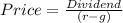

So, let´s take a look at the next equation.

Where r is the required rate of return.

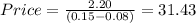

So, for part a) if $2.20 is next dividend, the equation would look as follows.

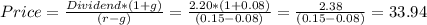

On the other hand, if $2.20 was last dividend, the equation would look like this.

Either way, the actual price to pay for the stock is lower than what you are ready to pay in order to make a 15% return, in other words, you find the price of this stock to be "cheap" when compared to what you are ready to pay in order to get your profits. But it would be nice to know that detail in regards the dividend. In this case it made no difference but it would if the actual price of the stock was $32.

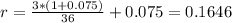

To solve b) let´s assume what we did in part a). that $3 were the last divivdens per share, so the equation to find the required rate of return would be:

It means:

Therefore, the implied rate of return would be 16.46%.

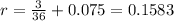

But, let´s run that extra mile, lets pretend that $3 are the next dividend, so r is:

So, if $3 are the next dividends, the implied rate of return would be 15.83%

Best of luck.