Answer:

Value of the Treasury note at 11% YTM: $ 746,617.36

Step-by-step explanation:

The present value will be sum of the future cuopon payment and maturity at market rate.

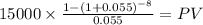

C 15,000 (1,000,000 x 3% / 2 payment per year)

time 8 (4 years x 2 payment per year)

rate 0.055 ( 11% annual / 2 payment per year)

PV $95,018.4898

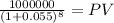

Maturity 1,000,000.00

time 8.00

rate 0.055

PV 651,598.87

PV coupon $ 95,018.4898

PV maturity $ 651,598.8707

Total $ 746,617.3605