Answer:

Future Price

F0: 126.89

F3: 113.13

F4: 113.41

Value of the contract:

a) zero (by definition)

b) -13

c) -13

Step-by-step explanation:

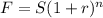

forward price:

being S the spot rate

time 9 months and

rate 2% continuous componding

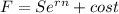

As the rate is continuous we calculate using the e number instead:

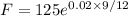

F = 125 x 1.015113065

F = 126.8891331 = 126.89

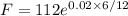

3th month into the contract:

F = 113.1256187 = 113.13

4th month

F = 113.4087866 = 113.41

value of the contract

at third month:

Vt = St - F0

Vt = 112 - 125 = -13

at fourth month

Vt = 112 - 125 = -13