Answer:

$1,109.62

Explanation:

Let's first compute the future value FV.

In order to see the rule of formation, let's see the value (in $) for the first few years

End of year 0

1,000

End of year 1(capital + interest + new deposit)

1,000*(1.09)+10

End of year 2 (capital + interest + new deposit)

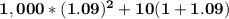

(1,000*(1.09)+10)*1.09 +10 =

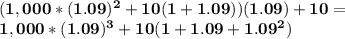

End of year 3 (capital + interest + new deposit)

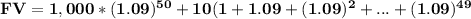

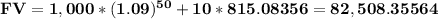

and we can see that at the end of year 50, the future value is

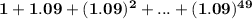

The sum

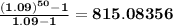

is the sum of a geometric sequence with common ratio 1.09 and is equal to

and the future value is then

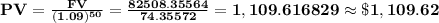

The present value PV is

rounded to the nearest hundredth.