Answer:

The current price of the bond is €883.25.

Step-by-step explanation:

The par value of bond is €1,000.

The years to maturity are 25 years.

The coupon rate is 6.7%.

The yield to maturity is 7.8%.

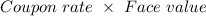

Coupon value

=

=

= €67

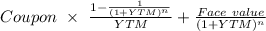

Bond price

=

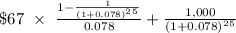

=

=

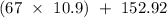

= 730.3 + 152.952

= 883.252 or 883.25