Answer:

Ans.

The cash flow that you paid at the purchase was $102.22

The cash flow that you received by selling it in year 4 (coupons and all) will be $137.54

The interest earned for holding it for 4 years is 8.66%

Step-by-step explanation:

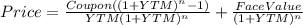

Hi, first, we need to find the price of the bond, that is with the following equation.

Where:

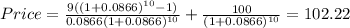

Coupon=100*0.09=9

YTM=0.0866

n = years to maturity, in our case, 10

So, what you pay for the bond is as follows.

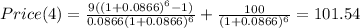

When you sell the bond, after receiving the 4th coupon, there is still 6 remaining coupons and the face value to be paid, so, the sell price in year 4 is:

So the cash flow received by hold this bond for 4 years is:

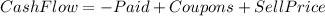

The right way to find the interest earned is by using the MS Excel function called, "IRR", but first you have to make a table in which you establish the right timing of receiving each cash flow, that should look like this.

Years Cash Flow

0 -$102,22

1 9

2 9

3 9

4 $110,54

IRR 8,66%

It is very important that you use the (-) sign in the beginning or the formula won´t work.

Besto of luck.