Answer:

The maturity risk premium for the security is 1.10%

Explanation:

Consider the provided information.

We need to determine the maturity risk premium on the six-year Treasury security.

It is given that Treasury rate is 7.25 percent for the six-year.

The expected inflation premium will be 2.40 percent in year 3 and beyond.

You expect that real interest rates will be 3.75 percent annually for the foreseeable future.

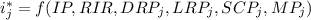

As we know the nominal interest rates is:

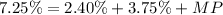

We have given

Nominal interest rate of security = 7.25

IP: Inflation premium of security = 2.40

RIP: Real interest rate of security = 3.75

We need to find MP (Maturity premium of security).

Substituting the respective values we get:

Hence, the maturity risk premium for the security is 1.10%