Answer:

$220,373.54 will investment in Inventory in order to achieve this goal.(ROA 9.37%)

Step-by-step explanation:

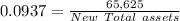

Net income = 5% of sales

= 0.05 × $1,312,500

= $65,625

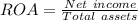

Return on assets (ROA) = 8.75%

as per the question we need ROA at 9.37%

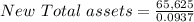

New total assets = $700,373.533

To obtain ROA of 9.37% the Miserly manufacturing Company's CPO has to Reduce its Total assets by $ 49,626.46

[$ 750,000 - $700,373.533 = $ 49,626.46]

for that CPO has to reduce inventory by $ 49,626.46

Initial Inventory = 36% of Total Assets

Inventory = 36% × $750,000

= $270,000

New order of Inventory is equal to $220,373.54 {$270,000 - $49,626.46}

$220,373.54 will investment in Inventory in order to achieve this goal.(ROA 9.37%)