Answer:

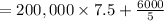

interest expense = = $16200

Step-by-step explanation:

Given data:

face value of bonds is $200,000

stated interest rate is 7.5%

interest expense is given as

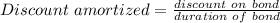

interest expense = cash payment + discount amortized

cash payment = face value × stated interest rate

= 200,000 × 7.5

Discount on bond = face value - issue price

= 200000 - (200000 × 97%)

= $6000

interest expense

interest expense = = $16200