Answer:

Allison: age 67

Leslie: 46 years

Step-by-step explanation:

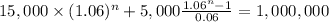

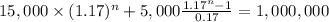

We are asked to find at which time the fund equal 1,000,000

both sister fund compose of a 15,000 lump sum and ordinary annuity of 5,000 dollars the difference will be the rate at which each capital works:

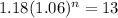

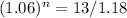

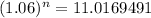

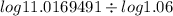

Alison:

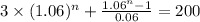

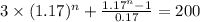

We divide by 5,000

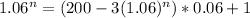

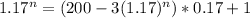

Then we clear the part:

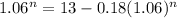

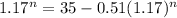

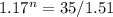

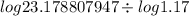

we use logarithmic properties to solve for n:

41.17864898

Allison will be a millionaire after 41.17 year. She start at age 26 so at age 67 she achieve his goal.

Leslie:

n = 20.02014878

Leslie will achieve it in 20.20 years

thus, at age 46