Answer:

$11,980.77

Step-by-step explanation:

Given;

On January 31

Units purchased= 400

Cost of each unit = $40

On February 28

Units purchased = 250

Cost of each unit = $25

Units sold from March 1 through December 31 = 300

Selling cost of each unit = $80

Now,

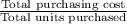

Average cost per unit =

or

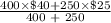

Average cost per unit =

or

Average cost per unit =

or

Average cost per unit = $34.23

Ending inventory on December 31 = Total units purchased - Total units sold

= 400 + 250 - 300

= 350 units

Therefore,

The cost of ending inventory = Units in the inventory × Cost per unit

= 350 × $34.23

= $11,980.77